Global copper demand is expected to grow by over 40% by 2040, but supply isn’t keeping pace. Meeting this demand may require 80 new mines and $250 billion in investment by 2030.

This edition of the Global Trade Update focuses on copper – the new strategic raw material at the heart of the global energy transition and digital transformation. It’s essential for electric vehicles, renewable energy systems, data centers, AI infrastructure and smart grids.

The report explores how to tackle supply challenges and, crucially, how to unlock copper’s development potential. It calls for smarter trade and industrial policies to help developing countries move up the copper value chain.

Key points

1. Supply constraints and long lead times signal a structural shortfall.

Over half of global copper reserves are located in just five countries – Chile, Australia, Peru, the Democratic Republic of the Congo and the Russian Federation (listed by size of reserves).

But reserves are only part of picture. Just one country – China – imports 60% of global copper ore and produces more than 45% of the world’s refined copper.

The outlook is further complicated by declining ore grades, rising geopolitical risks and long mine development timelines – now up to 25 years. Closing the supply gap will require faster permitting, better technology, stronger partnerships and more diversified trade routes.

2. Digging and shipping isn’t enough.

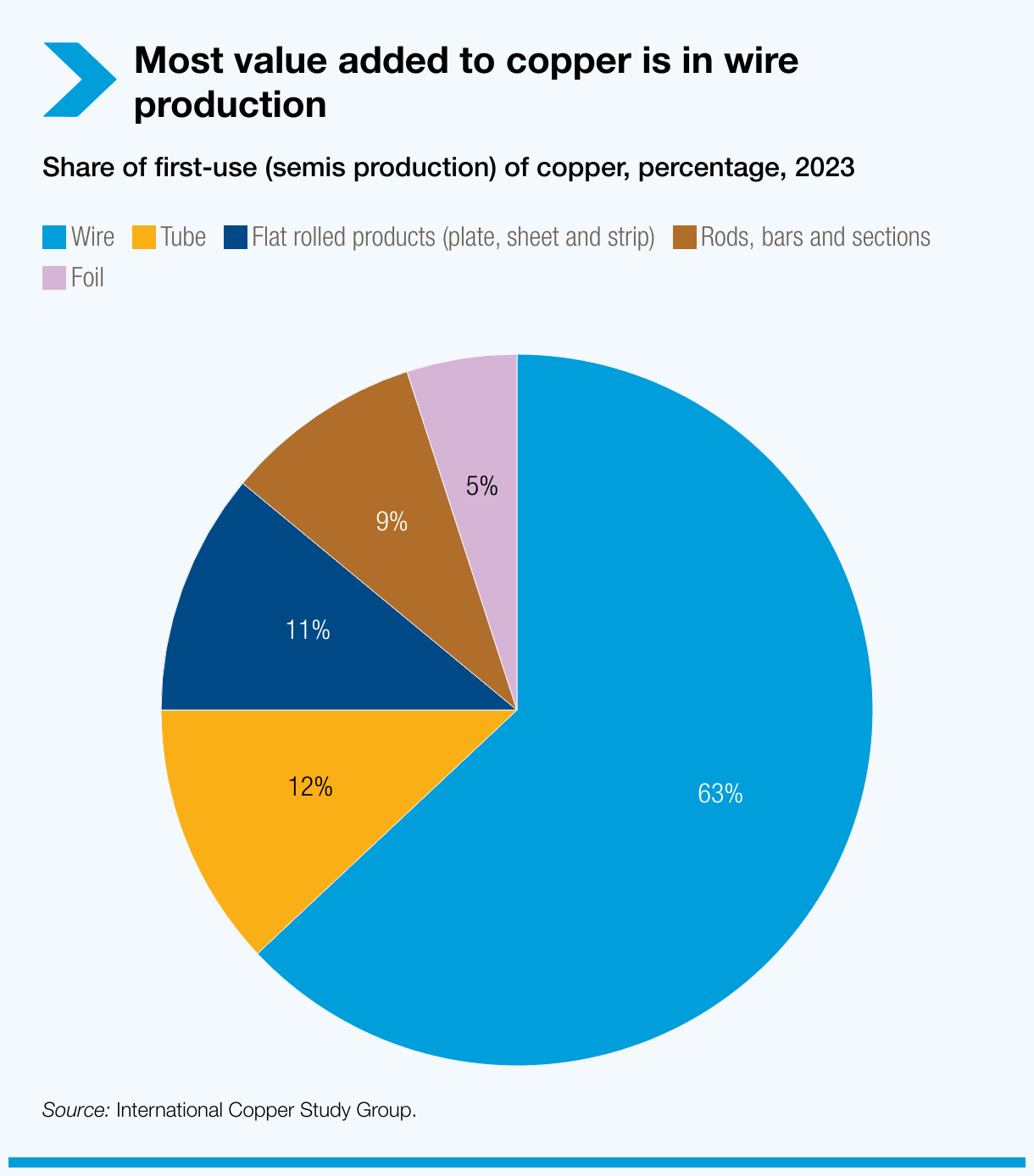

Raw copper brings limited returns. Value lies further up the chain – in wires, tubes and sheets, which are more complex and profitable. Yet most major copper exporters fall below the global average in economic complexity, reflecting limited capacity for industrial upgrading.

To move up the ladder, copper-rich developing countries must invest in refining, processing and manufacturing. This means strengthening infrastructure and skills, establishing industrial parks, offering tax incentives and pursuing trade policies that support higher-value production.

3. Tariff walls block the value ladder.

But when developing countries try to move up the chain, they face trade barriers. While refined copper typically faces tariffs below 2%, duties rise sharply – up to 8% – on finished products like wires, tubes and pipes.

This “tariff escalation” discourages value-added exports and locks producers into the role of raw material suppliers. See the Global Trade Update (March 20205) for more on tariff escalations.

4. Recycling will be essential to fill the supply gap.

With primary production lagging, recycling is becoming a key part of the solution. In 2023, secondary refined copper made up 4.5 million tonnes – nearly 20% of total output. It’s cheaper to produce, lowers emissions and performs just as well.

The United States is the world’s top exporter of copper scraps and waste, followed by Germany and Japan. Major importers include China, Canada and the Republic of Korea.

For developing countries, copper scrap could be a strategic asset. Investing in recycling and processing capacity can reduce import dependence, support value-added trade and advance a more circular, sustainable economy.